Here we are, one-third into 2021, and boy what a ride it has been so far. We all know that 2020 was a unique year full of challenges and change. The pandemic made us pause and reevaluate many aspects of our lives including where and how we live. The impact of the pandemic on the real estate market was significant, as people started to shift their housing priorities during the second half of 2020. Then the calendar turned to 2021 and the frenzy of all market frenzies began.

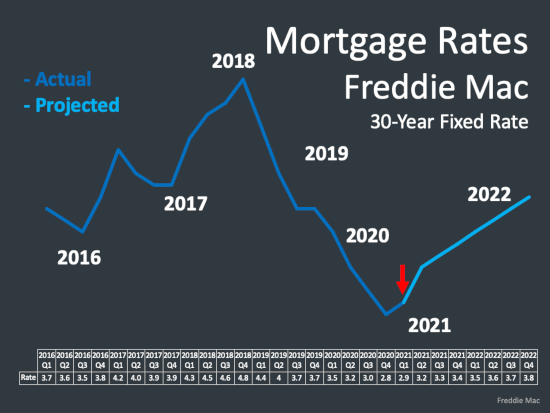

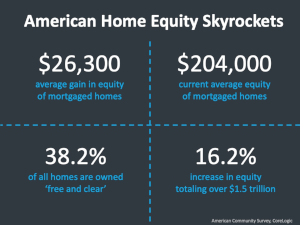

I had the misguided notion that closing out 2020 was going to lead to more normalcy in our industry as we all yearned to move on to the new year. Boy, was I shocked as Q1 unfolded; 2021 had its own agenda in store! What the new year brought, was its own set of drama as the economy headed towards recovery and the vaccine emerged. The continued historically low interest rates have fueled the housing pivots being made across our region and our country. Lifestyle moves have driven demand, but interest rates along with hearty equity levels have helped financially enable these life-changing moves. Interest rates have hovered around 3% since the beginning of the year. Additionally, 38% of all homeowners own their homes free and clear, and over 50% of homeowners have up to 50% equity.

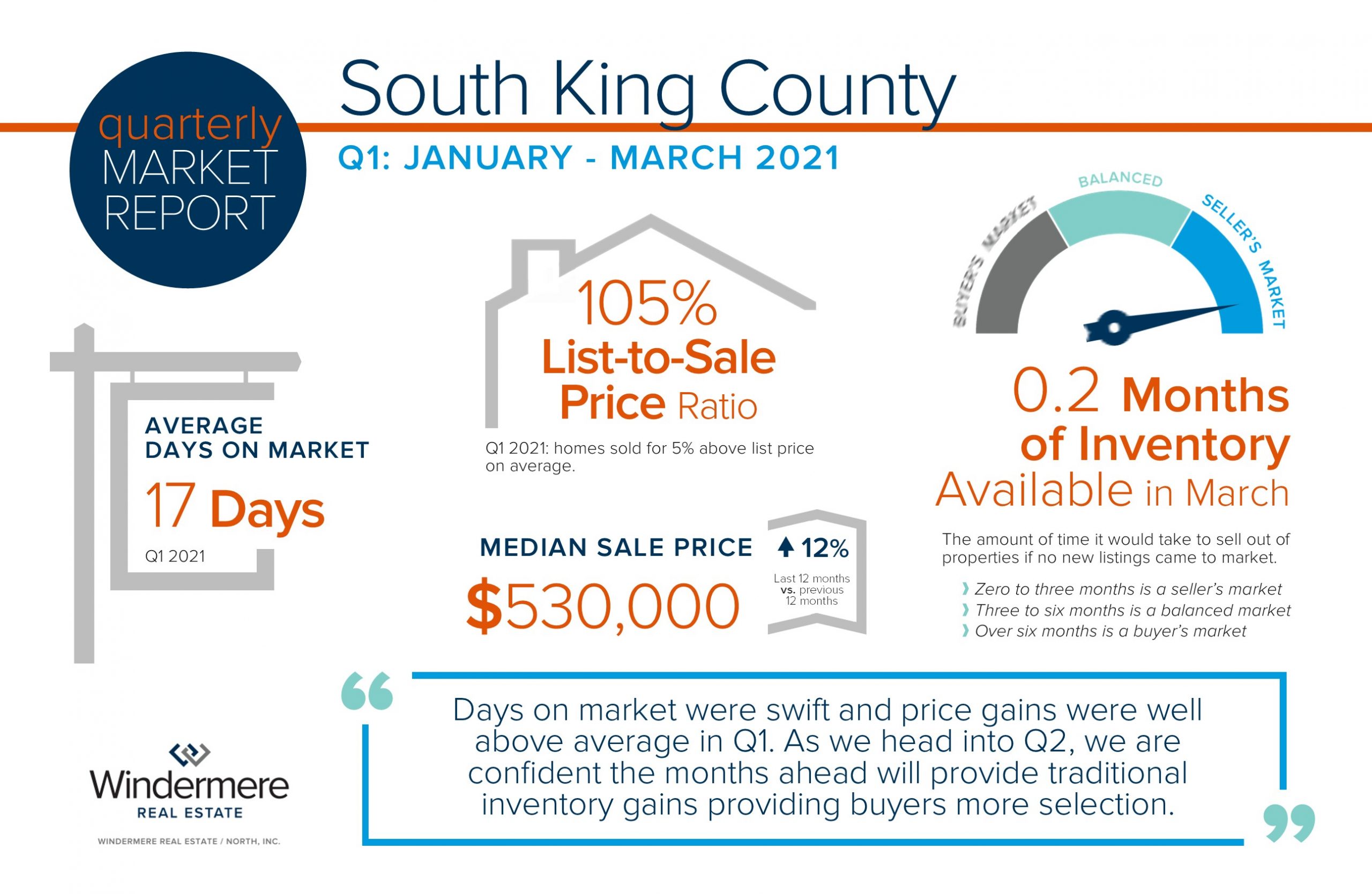

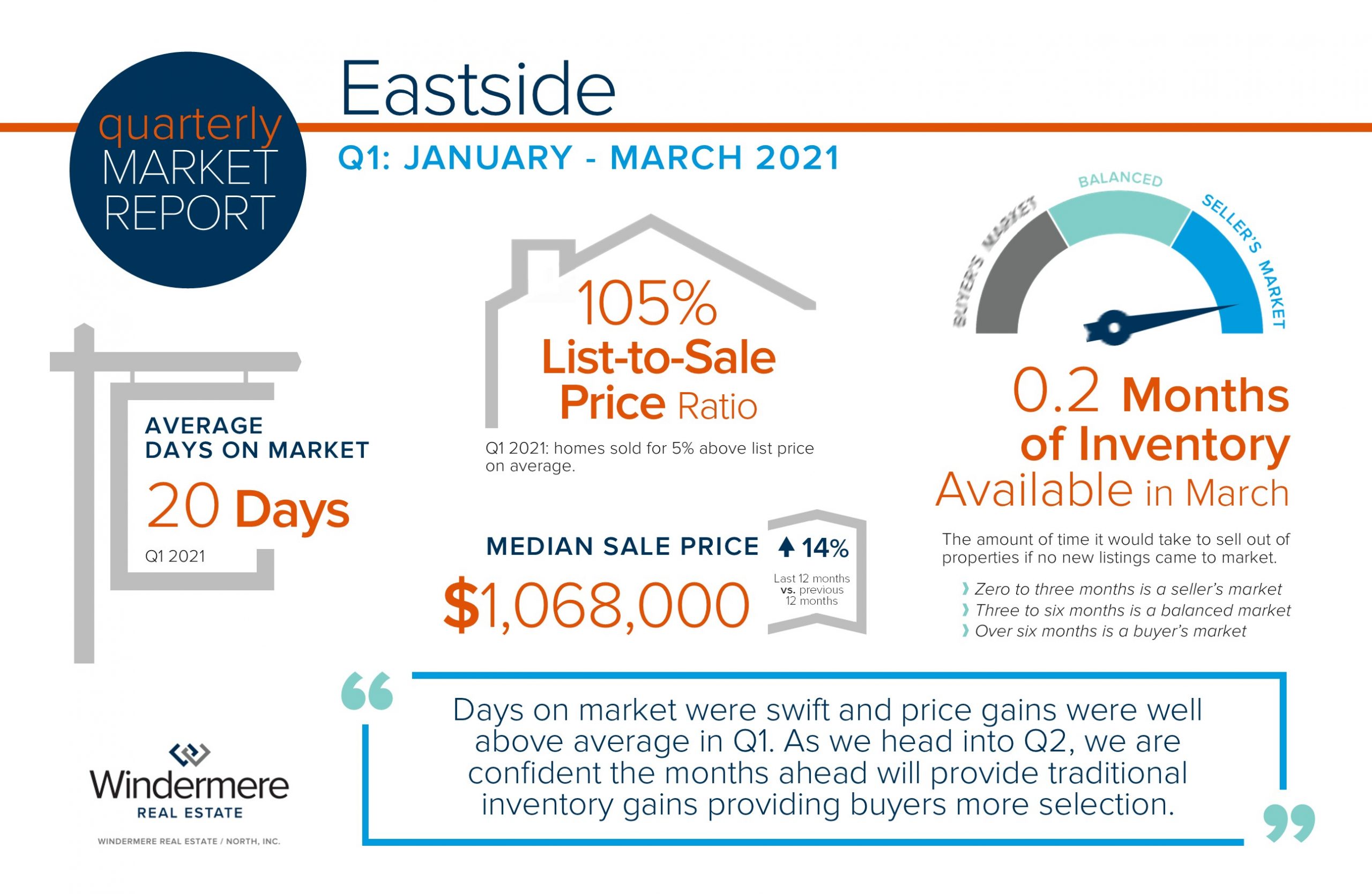

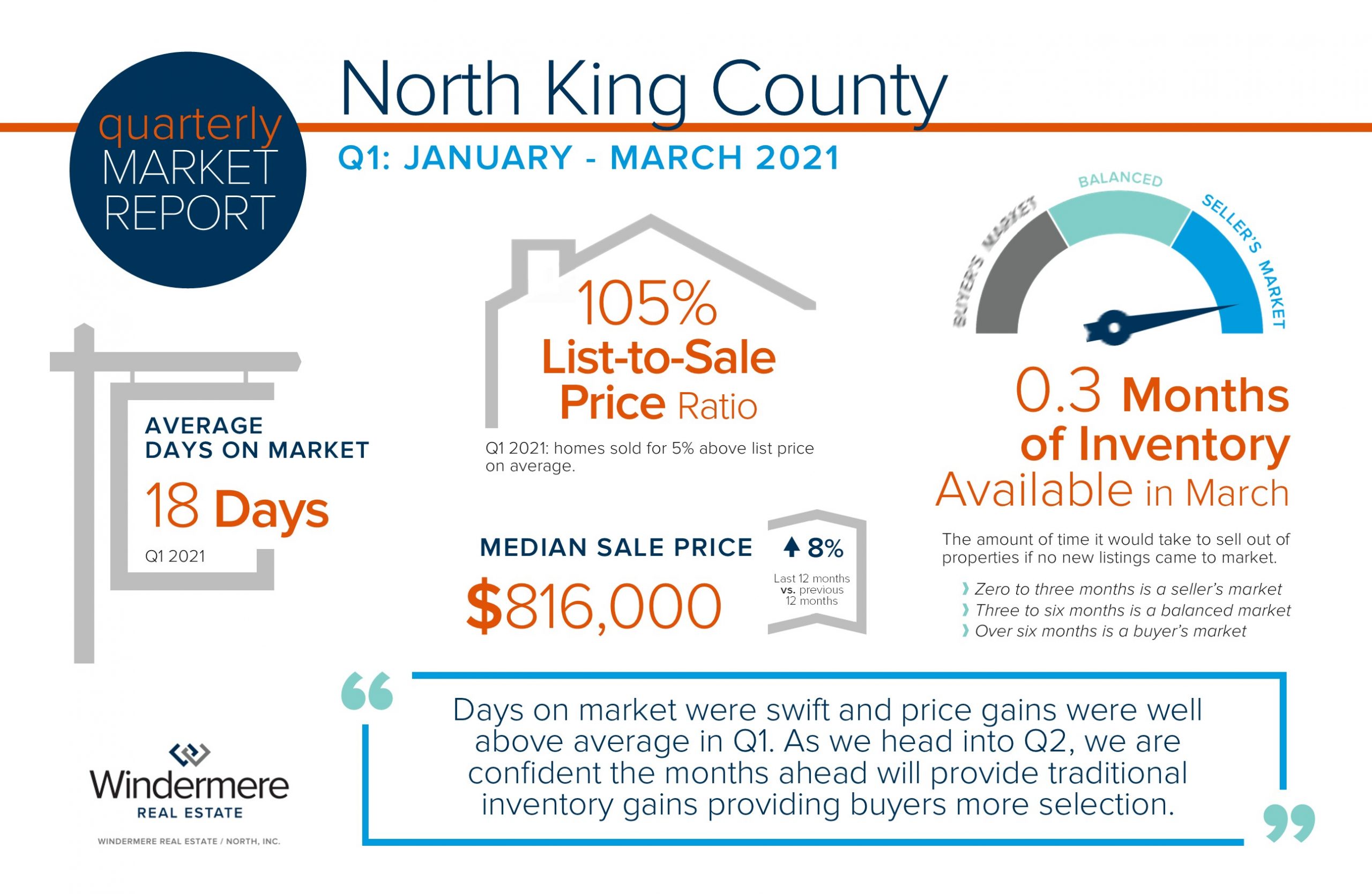

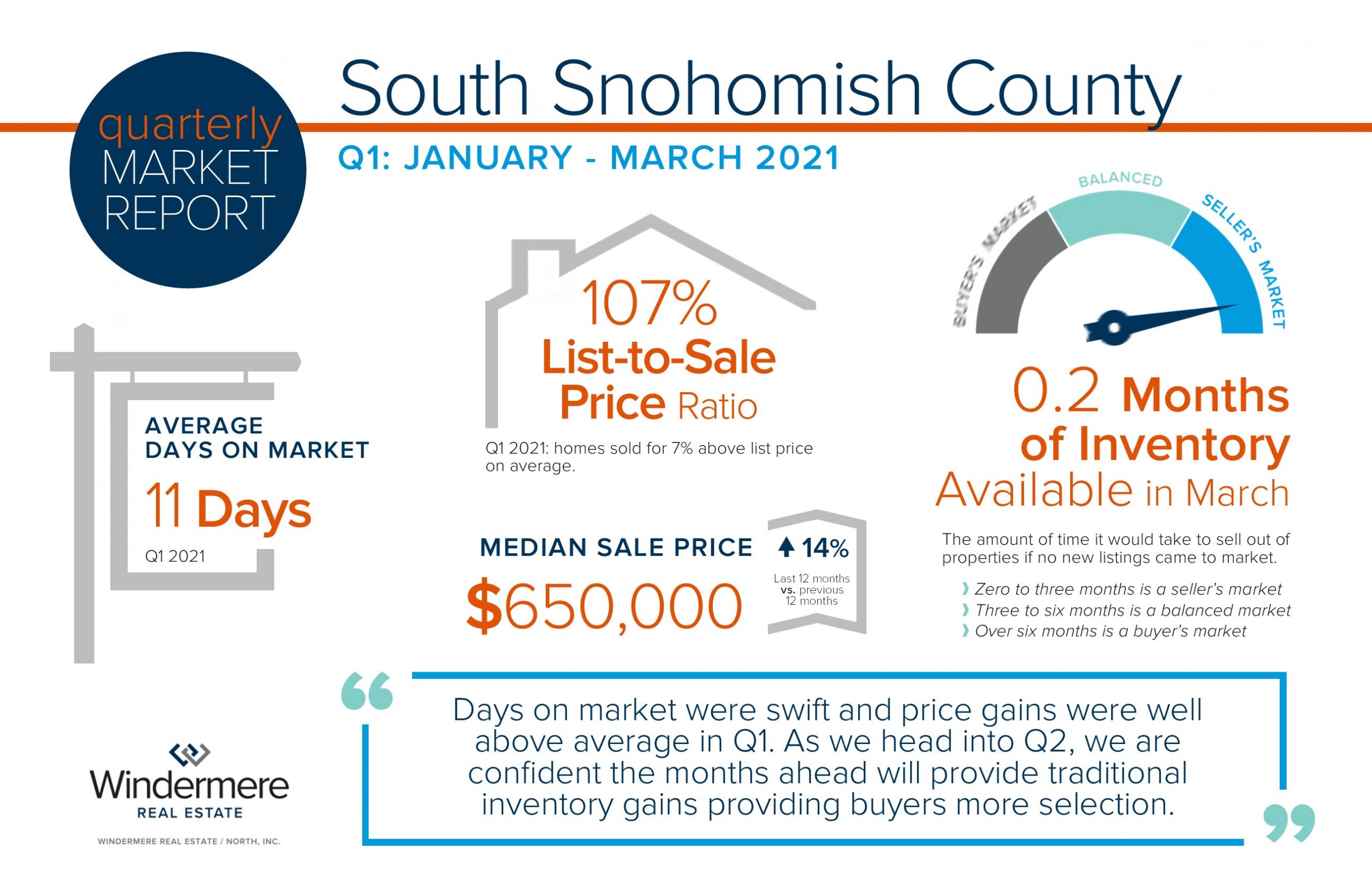

The work-from-home phenomenon (either permanent or hybrid) has re-shaped the housing market, driving many people to consider the suburbs or rural locations. Eliminating the daily commute into urban work centers has created flexibility for homeowners to live farther away from work and enjoy larger spaces and more affordable housing in comparison to cities like Seattle and Bellevue. In fact, the median home price in Snohomish County is up 15% complete year-over-year in comparison to King County at 10%. This is proof that suburban and rural housing is on the rise.

Demand (defined above) has helped to push price appreciation levels along with a shortage in available inventory. We have functioned in a lower-than-normal inventory market for over six years now. Zero to three months of inventory is defined as a seller’s market, three to six months a balanced market, and over six months a buyer’s market. This figure is established by estimating how long it would take to sell out of homes based on the closing or pending rate if no new homes came to market. In the second half of 2018, we eclipsed three months briefly but have mainly existed under three months for quite a while. In 2021, we have not breached one month, and in many submarkets have only had up to two weeks of available inventory.

2020 left a void of available inventory because we were in quarantine and many people were not comfortable opening their homes up to strangers. Plus, some people needed to pause and see how this was all going to shake out for them. I think the turn of the new year coupled with the vaccine has empowered people to make the moves they have been considering while they won the wait at home. We have a smattering of generations at the helm all wanting to make moves for different reasons. First-time home buyers, retirees, and move-up buyers are all hoping to take advantage of low debt service and pivot to a home with a better fit for their lifestyle goals.

Lifestyle demands, low rates, scarce inventory, and formidable equity have created a very competitive market. Large down payments due to moving equity from one home to the next, along with strict lending requirements have propped up the stability of the housing market. I am often asked if we are headed towards a housing bubble because of the rate of home appreciation, but it is important to understand that home values are supported by strong loan-to-value ratios and scrutinized lending. Unlike the Great Recession of 2008, when predatory lending (that involved low to no down payments and undocumented loans) formed an unstable foundation that eventually crumbled.

Lifestyle demands, low rates, scarce inventory, and formidable equity have created a very competitive market. Large down payments due to moving equity from one home to the next, along with strict lending requirements have propped up the stability of the housing market. I am often asked if we are headed towards a housing bubble because of the rate of home appreciation, but it is important to understand that home values are supported by strong loan-to-value ratios and scrutinized lending. Unlike the Great Recession of 2008, when predatory lending (that involved low to no down payments and undocumented loans) formed an unstable foundation that eventually crumbled.

The biggest challenge I see in the housing market in our region is affordability. It is expensive to live in the Greater Seattle area, plain and simple. The work-from-home option has provided flexibility to live farther out, which has put upward pressure on prices everywhere. We have had a re-organization of where people live and it has been surprising which communities have become attractive and in-demand. I predict at some point this will settle down as these newly refined housing needs find their place. Additionally, May through August is when we seasonally see more homes come to market. This should hopefully make it a bit easier for buyers to secure a home, and help soften the ramp-up on prices. This has already started to show itself over the last few weeks.

Financial indicators in our region are positive. Only 3.6% of homes in Washington state are in mortgage forbearance (a fraction of where we were at a year ago), tech jobs continue to drive employment, and the overall local economy and home equity are very strong. Your home is intended to be a long-term investment. If price appreciation starts to soften as we climb out of our inventory deficit this will be more sustainable for affordability. Buyers will still be on the road to building wealth with some of the lowest interest rates ever, and we must remember that homeownership is not just an investment but where we live and create memories. Sellers will continue to enjoy large payoffs as long-term equity growth is abundant. Keeping a grounded perspective will be key as the market twists and turns from the extremes. If there is anything I can guarantee it is that the market is always changing and it can change fast.

If you are curious about how today’s market relates to your lifestyle and financial goals, please reach out. I’d love to discuss your needs, curiosities, and concerns as this has been an intense and eventful start to 2021. It is always my goal to help keep my clients informed and empower strong decisions.

June 11th is our annual Windermere Community Service Day; our office will be volunteering alongside the Snohomish Garden Club helping plant nearly an acre of fruits and vegetables that will be harvested for local food banks. This will be our 5th year working on this project that yields thousands of pounds of fresh produce for the food insecure across our region.

Windermere Community Service Day is a 40-year long tradition of giving back to the communities in which we serve, it is a valued part of our Windermere culture. If you would like to donate to help us provide additional veggie starts and supplies, please reach out. I will report back on our project in my next newsletter, letting the planting begin!

Windermere and the Seattle Seahawks partnered for the fifth season to #TackleHomelessness, raising an additional $32,100 for Mary’s Place to support homeless children and families, bringing our total raised to $160,300! Read more on the Windermere blog.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

When you shop at a local Farmers Market, you’re buying outstanding freshness, quality and flavor. Knowing exactly where your food comes from and how it was grown provides peace of mind for your family. Plus, you’re supporting a sustainable regional food system that helps small family farms stay in business; protects land from over-development, and provides the community with fresh, healthy food. Find one near you on the list below!

When you shop at a local Farmers Market, you’re buying outstanding freshness, quality and flavor. Knowing exactly where your food comes from and how it was grown provides peace of mind for your family. Plus, you’re supporting a sustainable regional food system that helps small family farms stay in business; protects land from over-development, and provides the community with fresh, healthy food. Find one near you on the list below!